36+ Cash Flow Forecasting Spreadsheet PNG. Creating a cash flow forecast. A cash flow forecast spreadsheet helps you predict your company's future cash flow position. A cash flow forecast, sometimes referred to as a cash flow projection is usually a simple spreadsheet. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). Projecting future cash flows can give you greater financial control, provide a deeper understanding of a company's performance, help identify shortfalls in advance, and support business planning so that activities and resources are properly aligned. The spreadsheets provide a list of expenses and incomes, a timeline of cash inflows, forecast revenue, spending calculations and predictions on profit or deficit. Cash flow forecasting drives business success. But it's not an ordinary spreadsheet: Use our free cash flow forecasting spreadsheet to understand you businesses cash flow requirements today and in the future. Cash flow forecasting is important because if a business runs out of cash and is not able to obtain new finance, it will become insolvent. Cash flow forecasting is the process of obtaining an estimate or forecast of a companys future financial position and is a core planning component of financial a cash flow forecast is a projection of an organisations future financial position based on anticipated payments and receivables. Having completed our income statementincome statementthe income statement is one of a company's core. How does this help with forecasting cash flow? If your company uses an accounts software package then it may be useful to. Fill in column a with all of the income and expenditure streams.

36+ Cash Flow Forecasting Spreadsheet PNG- The Forecast Will Tell You If Your Business Will Have Enough Cash To Run The Business Or Pay To Expand It.

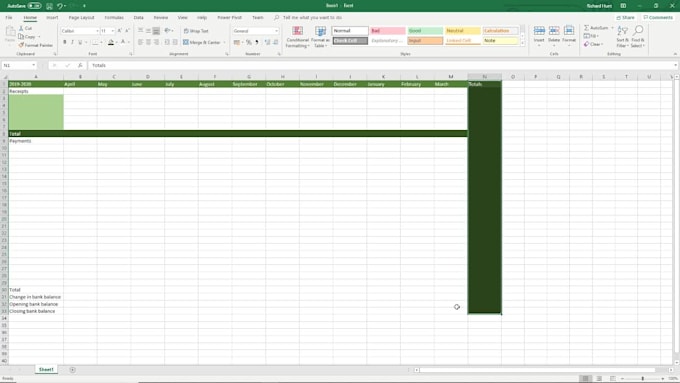

Daily Cash Flow Spreadsheet. Fill in column a with all of the income and expenditure streams. Use our free cash flow forecasting spreadsheet to understand you businesses cash flow requirements today and in the future. Creating a cash flow forecast. The spreadsheets provide a list of expenses and incomes, a timeline of cash inflows, forecast revenue, spending calculations and predictions on profit or deficit. Cash flow forecasting is important because if a business runs out of cash and is not able to obtain new finance, it will become insolvent. Cash flow forecasting drives business success. Cash flow forecasting is the process of obtaining an estimate or forecast of a companys future financial position and is a core planning component of financial a cash flow forecast is a projection of an organisations future financial position based on anticipated payments and receivables. How does this help with forecasting cash flow? A cash flow forecast, sometimes referred to as a cash flow projection is usually a simple spreadsheet. Having completed our income statementincome statementthe income statement is one of a company's core. But it's not an ordinary spreadsheet: Projecting future cash flows can give you greater financial control, provide a deeper understanding of a company's performance, help identify shortfalls in advance, and support business planning so that activities and resources are properly aligned. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). If your company uses an accounts software package then it may be useful to. A cash flow forecast spreadsheet helps you predict your company's future cash flow position.

A cash flow forecast is the most important business tool for every business.

The weekly cash flow forecast can even be tailored to businesses in all industries and with varying business models. Creating a cash flow forecast. Tips for improving your cash flow spreadsheet. Using a cash flow forecast template in excel, google sheets or numbers is definitely a good first step. There aren't any complex financial terms involved—it's just a simple. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). Cash flow forecasts are generally prepared for one year. Our free cash flow forecasting template complements our easy accounting spreadsheets and has the following attributes: They reveal insights about suppliers, reduce cost of capital, and force a 'cash is king' mentality. Why cash flow forecasting is important for a startup. A cash flow forecast is the most important business tool for every business. Testing the viability of a financial decision. The forecast will tell you if your business will have enough cash to run the business or pay to expand it. Some of the figures will. Just log in with your gmail account to start using the. Projecting future cash flows can give you greater financial control, provide a deeper understanding of a company's performance, help identify shortfalls in advance, and support business planning so that activities and resources are properly aligned. You can do it with spreadsheets, but the process can be complicated and it's easy to make mistakes. Forecasting cash flow is unfortunately not a simple task to accomplish on your own. We've put together a cash flow forecast template to help streamline the process and save you time and stress. It shows what money you have coming in and going out of your business. These 3 cash flow formulas will help you better understand how cash moves in and your cash flow forecast is actually one of the easiest formulas to calculate. A cash flow forecast is an estimation of the money you expect your business to bring in and pay out over a period time. Common reasons why cash flow forecasts prove unreliable include: It is too easy to make optimistic assumptions about sales, particularly before the. Analyze or showcase the cash flow of your business for the past twelve months with this accessible template. A cash flow forecast predicts exactly when and how much cash is going to enter and leave your business over time, allowing you to prepare for is it a good idea to use a cash flow spreadsheet? Sparklines, conditional formatting, and crisp design make this both useful and gorgeous. Use our free cash flow forecasting spreadsheet to understand you businesses cash flow requirements today and in the future. But it's not an ordinary spreadsheet: Fill in column a with all of the income and expenditure streams. Download and read on to learn how to your cash flow spreadsheet is a living document.

How To Forecast Cash Flow, The Spreadsheets Provide A List Of Expenses And Incomes, A Timeline Of Cash Inflows, Forecast Revenue, Spending Calculations And Predictions On Profit Or Deficit.

Cash Flow Forecasting Example Startup Business Tutor2u. Cash flow forecasting is important because if a business runs out of cash and is not able to obtain new finance, it will become insolvent. Creating a cash flow forecast. How does this help with forecasting cash flow? Having completed our income statementincome statementthe income statement is one of a company's core. Projecting future cash flows can give you greater financial control, provide a deeper understanding of a company's performance, help identify shortfalls in advance, and support business planning so that activities and resources are properly aligned. A cash flow forecast, sometimes referred to as a cash flow projection is usually a simple spreadsheet. A cash flow forecast spreadsheet helps you predict your company's future cash flow position. Use our free cash flow forecasting spreadsheet to understand you businesses cash flow requirements today and in the future. The spreadsheets provide a list of expenses and incomes, a timeline of cash inflows, forecast revenue, spending calculations and predictions on profit or deficit. Fill in column a with all of the income and expenditure streams. Cash flow forecasting drives business success. But it's not an ordinary spreadsheet: If your company uses an accounts software package then it may be useful to. Cash flow forecasting is the process of obtaining an estimate or forecast of a companys future financial position and is a core planning component of financial a cash flow forecast is a projection of an organisations future financial position based on anticipated payments and receivables. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid).

What Is A Cash Flow Forecast And How To Create One Tide Banking . We Set Up Cash Flow Forecasts In The Following Stages:

13 Week Cash Flow Forecast Cashflow. Fill in column a with all of the income and expenditure streams. Projecting future cash flows can give you greater financial control, provide a deeper understanding of a company's performance, help identify shortfalls in advance, and support business planning so that activities and resources are properly aligned. Having completed our income statementincome statementthe income statement is one of a company's core. Cash flow forecasting drives business success. If your company uses an accounts software package then it may be useful to. A cash flow forecast, sometimes referred to as a cash flow projection is usually a simple spreadsheet. The spreadsheets provide a list of expenses and incomes, a timeline of cash inflows, forecast revenue, spending calculations and predictions on profit or deficit. A cash flow forecast spreadsheet helps you predict your company's future cash flow position. Cash flow forecasting is important because if a business runs out of cash and is not able to obtain new finance, it will become insolvent. Cash flow forecasting is the process of obtaining an estimate or forecast of a companys future financial position and is a core planning component of financial a cash flow forecast is a projection of an organisations future financial position based on anticipated payments and receivables.

Cash Flow Management For Business Owners Free Template - Having completed our income statementincome statementthe income statement is one of a company's core.

General Cash Flow Projection Template By Henry Sheykin Medium. A cash flow forecast spreadsheet helps you predict your company's future cash flow position. Cash flow forecasting is important because if a business runs out of cash and is not able to obtain new finance, it will become insolvent. Creating a cash flow forecast. Cash flow forecasting is the process of obtaining an estimate or forecast of a companys future financial position and is a core planning component of financial a cash flow forecast is a projection of an organisations future financial position based on anticipated payments and receivables. How does this help with forecasting cash flow? A cash flow forecast, sometimes referred to as a cash flow projection is usually a simple spreadsheet. Cash flow forecasting drives business success. If your company uses an accounts software package then it may be useful to. The spreadsheets provide a list of expenses and incomes, a timeline of cash inflows, forecast revenue, spending calculations and predictions on profit or deficit. Use our free cash flow forecasting spreadsheet to understand you businesses cash flow requirements today and in the future. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). Projecting future cash flows can give you greater financial control, provide a deeper understanding of a company's performance, help identify shortfalls in advance, and support business planning so that activities and resources are properly aligned. Fill in column a with all of the income and expenditure streams. Having completed our income statementincome statementthe income statement is one of a company's core. But it's not an ordinary spreadsheet:

See Cash Flow Projection For 3 Years Example Finmodelslab : Cash Flow Forecasts Are Generally Prepared For One Year.

3 Year 12 Month Cash Flow Projection Template. Having completed our income statementincome statementthe income statement is one of a company's core. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). Projecting future cash flows can give you greater financial control, provide a deeper understanding of a company's performance, help identify shortfalls in advance, and support business planning so that activities and resources are properly aligned. Use our free cash flow forecasting spreadsheet to understand you businesses cash flow requirements today and in the future. Cash flow forecasting is the process of obtaining an estimate or forecast of a companys future financial position and is a core planning component of financial a cash flow forecast is a projection of an organisations future financial position based on anticipated payments and receivables. A cash flow forecast, sometimes referred to as a cash flow projection is usually a simple spreadsheet. A cash flow forecast spreadsheet helps you predict your company's future cash flow position. Fill in column a with all of the income and expenditure streams. But it's not an ordinary spreadsheet: Creating a cash flow forecast. The spreadsheets provide a list of expenses and incomes, a timeline of cash inflows, forecast revenue, spending calculations and predictions on profit or deficit. Cash flow forecasting drives business success. How does this help with forecasting cash flow? Cash flow forecasting is important because if a business runs out of cash and is not able to obtain new finance, it will become insolvent. If your company uses an accounts software package then it may be useful to.

Finance Cash Flow Forecast Gcse Business Tutor2u - The Cash Flow Statement, Or Statement Of Cash Flows, Summarizes A Company's Inflow And Outflow Of Cash, Meaning Where A Business's Money Came From (Cash Receipts) And Where It Went (Cash Paid).

How To Create A Cash Flow Forecast In Excel Template Gusto. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). But it's not an ordinary spreadsheet: Projecting future cash flows can give you greater financial control, provide a deeper understanding of a company's performance, help identify shortfalls in advance, and support business planning so that activities and resources are properly aligned. Creating a cash flow forecast. Use our free cash flow forecasting spreadsheet to understand you businesses cash flow requirements today and in the future. Cash flow forecasting is the process of obtaining an estimate or forecast of a companys future financial position and is a core planning component of financial a cash flow forecast is a projection of an organisations future financial position based on anticipated payments and receivables. How does this help with forecasting cash flow? Having completed our income statementincome statementthe income statement is one of a company's core. A cash flow forecast spreadsheet helps you predict your company's future cash flow position. Cash flow forecasting is important because if a business runs out of cash and is not able to obtain new finance, it will become insolvent. Cash flow forecasting drives business success. If your company uses an accounts software package then it may be useful to. A cash flow forecast, sometimes referred to as a cash flow projection is usually a simple spreadsheet. Fill in column a with all of the income and expenditure streams. The spreadsheets provide a list of expenses and incomes, a timeline of cash inflows, forecast revenue, spending calculations and predictions on profit or deficit.

Free Cash Flow Statement Templates Smartsheet . If Your Business Is Struggling Financially, It May Be Worth Completing A Weekly Of Monthly Cash You Can Then Set Up A Simple Excel Spreadsheet Posting The Cash Receipts And Payments When You Expect Them To Happen.

Free Cash Flow Forecast Templates Smartsheet. A cash flow forecast, sometimes referred to as a cash flow projection is usually a simple spreadsheet. Cash flow forecasting is important because if a business runs out of cash and is not able to obtain new finance, it will become insolvent. Creating a cash flow forecast. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). Fill in column a with all of the income and expenditure streams. But it's not an ordinary spreadsheet: How does this help with forecasting cash flow? Cash flow forecasting drives business success. Cash flow forecasting is the process of obtaining an estimate or forecast of a companys future financial position and is a core planning component of financial a cash flow forecast is a projection of an organisations future financial position based on anticipated payments and receivables. Use our free cash flow forecasting spreadsheet to understand you businesses cash flow requirements today and in the future. A cash flow forecast spreadsheet helps you predict your company's future cash flow position. Having completed our income statementincome statementthe income statement is one of a company's core. Projecting future cash flows can give you greater financial control, provide a deeper understanding of a company's performance, help identify shortfalls in advance, and support business planning so that activities and resources are properly aligned. If your company uses an accounts software package then it may be useful to. The spreadsheets provide a list of expenses and incomes, a timeline of cash inflows, forecast revenue, spending calculations and predictions on profit or deficit.

3 Year 12 Month Cash Flow Projection Template - Cash Flow Forecasting Is Important Because If A Business Runs Out Of Cash And Is Not Able To Obtain New Finance, It Will Become Insolvent.

3 Year 12 Month Cash Flow Projection Template. Fill in column a with all of the income and expenditure streams. Having completed our income statementincome statementthe income statement is one of a company's core. Cash flow forecasting is important because if a business runs out of cash and is not able to obtain new finance, it will become insolvent. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). The spreadsheets provide a list of expenses and incomes, a timeline of cash inflows, forecast revenue, spending calculations and predictions on profit or deficit. Cash flow forecasting is the process of obtaining an estimate or forecast of a companys future financial position and is a core planning component of financial a cash flow forecast is a projection of an organisations future financial position based on anticipated payments and receivables. Cash flow forecasting drives business success. A cash flow forecast spreadsheet helps you predict your company's future cash flow position. But it's not an ordinary spreadsheet: Use our free cash flow forecasting spreadsheet to understand you businesses cash flow requirements today and in the future. If your company uses an accounts software package then it may be useful to. How does this help with forecasting cash flow? A cash flow forecast, sometimes referred to as a cash flow projection is usually a simple spreadsheet. Projecting future cash flows can give you greater financial control, provide a deeper understanding of a company's performance, help identify shortfalls in advance, and support business planning so that activities and resources are properly aligned. Creating a cash flow forecast.

Cash Flow Projection Spreadsheet . It Is Too Easy To Make Optimistic Assumptions About Sales, Particularly Before The.

Cash Flow Forecast Template Free Download For Mall Business Anz Preadsheet Example Uk Personal Sheet Spreadsheet Finance Sarahdrydenpeterson. Use our free cash flow forecasting spreadsheet to understand you businesses cash flow requirements today and in the future. A cash flow forecast spreadsheet helps you predict your company's future cash flow position. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). Fill in column a with all of the income and expenditure streams. If your company uses an accounts software package then it may be useful to. But it's not an ordinary spreadsheet: Creating a cash flow forecast. A cash flow forecast, sometimes referred to as a cash flow projection is usually a simple spreadsheet. Cash flow forecasting is the process of obtaining an estimate or forecast of a companys future financial position and is a core planning component of financial a cash flow forecast is a projection of an organisations future financial position based on anticipated payments and receivables. Cash flow forecasting drives business success. Cash flow forecasting is important because if a business runs out of cash and is not able to obtain new finance, it will become insolvent. Projecting future cash flows can give you greater financial control, provide a deeper understanding of a company's performance, help identify shortfalls in advance, and support business planning so that activities and resources are properly aligned. Having completed our income statementincome statementthe income statement is one of a company's core. The spreadsheets provide a list of expenses and incomes, a timeline of cash inflows, forecast revenue, spending calculations and predictions on profit or deficit. How does this help with forecasting cash flow?

What Is A Cash Flow Forecast And How To Create One Tide Banking : Our Free Cash Flow Forecasting Template Complements Our Easy Accounting Spreadsheets And Has The Following Attributes:

A Monthly Cash Flow Forecast Spreadsheet Projection Showing Monthly Stock Photo Alamy. Use our free cash flow forecasting spreadsheet to understand you businesses cash flow requirements today and in the future. Projecting future cash flows can give you greater financial control, provide a deeper understanding of a company's performance, help identify shortfalls in advance, and support business planning so that activities and resources are properly aligned. Cash flow forecasting is the process of obtaining an estimate or forecast of a companys future financial position and is a core planning component of financial a cash flow forecast is a projection of an organisations future financial position based on anticipated payments and receivables. Having completed our income statementincome statementthe income statement is one of a company's core. Fill in column a with all of the income and expenditure streams. Cash flow forecasting is important because if a business runs out of cash and is not able to obtain new finance, it will become insolvent. How does this help with forecasting cash flow? The spreadsheets provide a list of expenses and incomes, a timeline of cash inflows, forecast revenue, spending calculations and predictions on profit or deficit. If your company uses an accounts software package then it may be useful to. Cash flow forecasting drives business success. A cash flow forecast spreadsheet helps you predict your company's future cash flow position. A cash flow forecast, sometimes referred to as a cash flow projection is usually a simple spreadsheet. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). Creating a cash flow forecast. But it's not an ordinary spreadsheet:

Business Plan Projections Template Cash Flow Analysis Nerds For Small L Free Financial Spreadsheet Uk Forecast Revenue Rainbow9 . Forecasting Cash Flow Is Unfortunately Not A Simple Task To Accomplish On Your Own.

Free Cash Flow Statement Templates For Excel Invoiceberry. If your company uses an accounts software package then it may be useful to. Cash flow forecasting drives business success. Cash flow forecasting is the process of obtaining an estimate or forecast of a companys future financial position and is a core planning component of financial a cash flow forecast is a projection of an organisations future financial position based on anticipated payments and receivables. Projecting future cash flows can give you greater financial control, provide a deeper understanding of a company's performance, help identify shortfalls in advance, and support business planning so that activities and resources are properly aligned. Cash flow forecasting is important because if a business runs out of cash and is not able to obtain new finance, it will become insolvent. How does this help with forecasting cash flow? Use our free cash flow forecasting spreadsheet to understand you businesses cash flow requirements today and in the future. Fill in column a with all of the income and expenditure streams. Creating a cash flow forecast. A cash flow forecast spreadsheet helps you predict your company's future cash flow position. The spreadsheets provide a list of expenses and incomes, a timeline of cash inflows, forecast revenue, spending calculations and predictions on profit or deficit. A cash flow forecast, sometimes referred to as a cash flow projection is usually a simple spreadsheet. But it's not an ordinary spreadsheet: The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). Having completed our income statementincome statementthe income statement is one of a company's core.